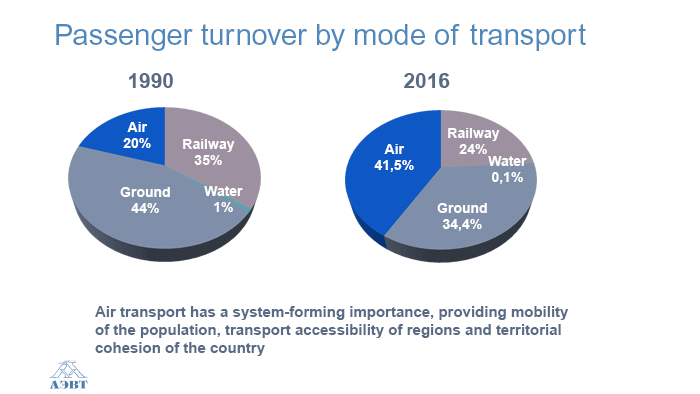

Russian airlines successfully operate modern aircraft of domestic and Western production, and ubiquitous introduction of advanced IT technologies. Domestic air carriers deservedly and with an enviable regularity fall on the first lines of ratings of the leading international rating agencies in the field of civil aviation.

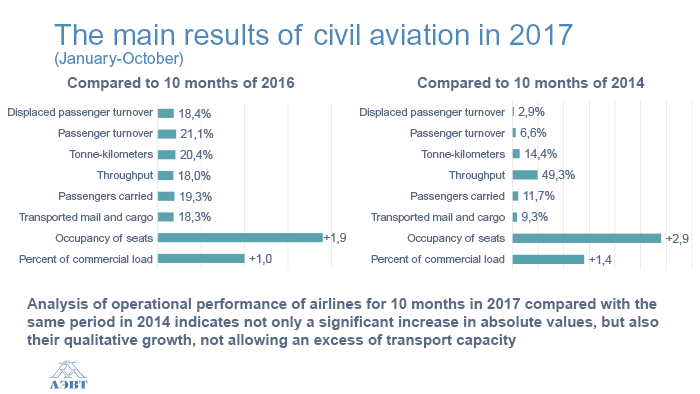

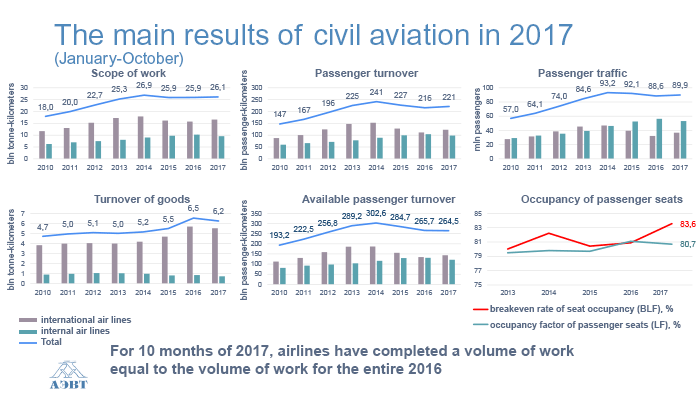

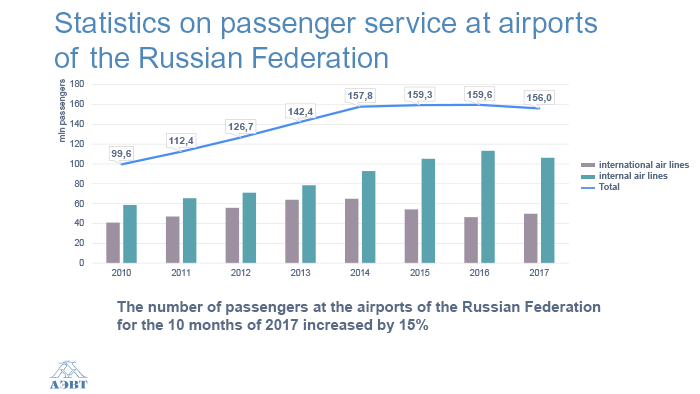

In 2017 Russian air transport market is actively restoring growth. Thus, for the 10 months of this year, the growth in operational performance of airlines by the corresponding period of 2016 amounted to:

- passenger turnover + 21.1%

- passenger traffic + 19.3%

- Employment of passenger seats + 1.9 percentage points.

Partly high rates of growth in total passenger traffic for the 10 months of 2017 are due to the rapid growth in recovery growth at the International Air Lines (IAL) - + 34.8%. According to information from tour operators, the intensity of orders and bookings made by customers carrying out air travel with the purposes of tourism and recreation has grown many times in comparison with the indicators of 2016. The summer season of 2017 was marked by a strong demand for the recently "newly" open Turkey and a significantly increased flow of Russians to foreign resorts.

The growth of passenger traffic on the Internal Air Line (IAL) for 10 months of 2017 amounted to 10.5% with an increase in the occupancy rate of passenger seats by 0.7 percentage points. It should be noted that the growth of passenger transportation to the airfield is stable and long-term.

Comparative data on the volume of air traffic services in the country's airspace also indicate a steady increase in flights this year. For 10 months of 2017 the airlines performed a volume of work equal to the volume of work for the entire 2016.

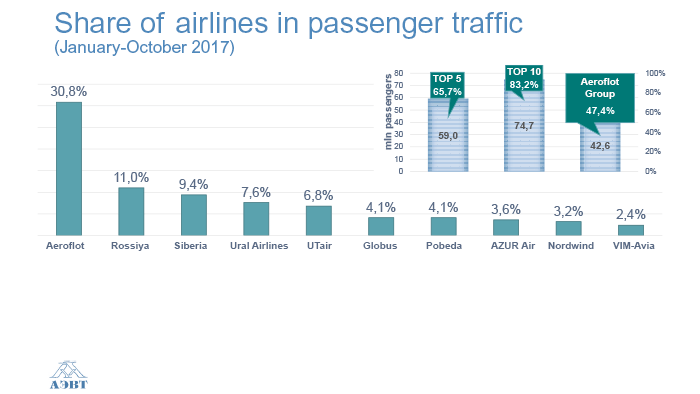

According to experts in 2017, Russian airlines as a whole will transport about 100-105 million passengers. It should be recognised that not all airlines in the current year have chosen a balanced development strategy appropriate to their financial capabilities, as evidenced by the negative situation that has developed in connection with the collapse of tourist traffic due to the airline VIM-Avia.

At the same time, the activities of Russian civil aviation at the present stage are conditioned by a number of factors: unstable post-crisis stabilisation of the country's economy, continuing uncertainty in the development of international transport markets, both on regular and charter (primarily resort) routes.

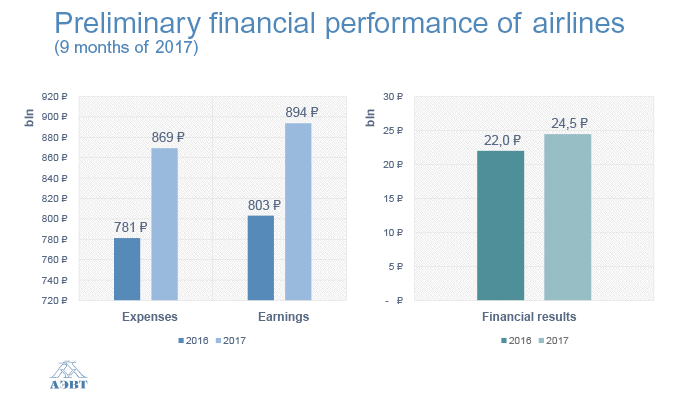

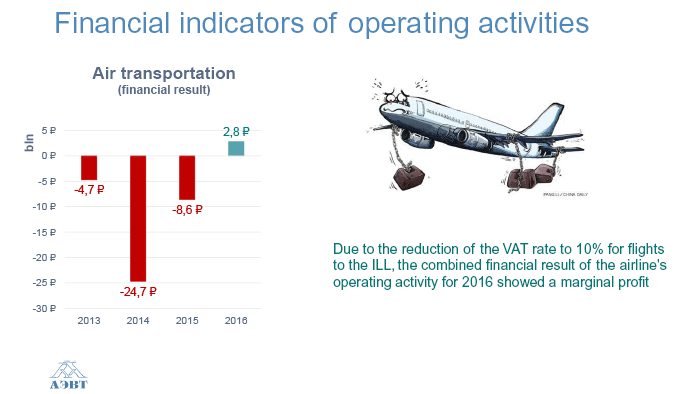

Financial indicators

According to the Federal State Statistics Service, the real incomes of the country's population have been declining for the fourth consecutive year. In 2014, the decrease was 0.7%, in 2015 - 3.2%, in 2016 - 5.9%. Against this backdrop, with regard to the financial performance of airlines in general for the CA of the Russian Federation, according to the updated data for 2016, for the first time since 2010 the aggregate financial result turned out to be positive and amounted to about 2.8 billion rubles.

For 9 months of 2017 the revenue of airlines grew by 11%. At the same time, passenger traffic and passenger turnover increased by 19% and 21%, respectively.

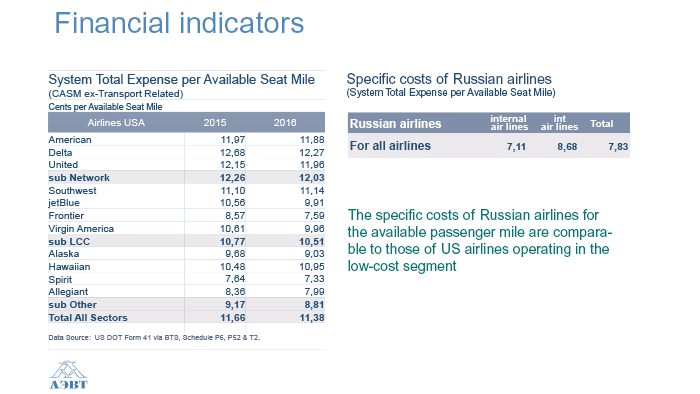

The positive result is achieved, mainly due to the control of airlines for costs, an adequate pricing policy and the reduction by the state from July 2015 to 10% of the VAT rate for the ATL. In other words, airlines for a smaller amount of money have done more work.

Russian airlines often hear accusations of inflating prices for air transportation in Domestic Flights. But is it really so? To begin with, we recall that by the end of 2016, Russian airlines for transportation in Domestic Flights received a total operating loss of 20 billion rubles. Thus, the International Flights is consistently provided with operating profit, while the Domestic Flights remains highly unprofitable.

Average freight charge for regular flights (rubles):

|

Routes |

9 months 2016 |

9 months 2017 |

Difference |

|

International Flights |

16 352 |

14 518 |

- 11,2% |

|

Domestic Flights |

7 685 |

7 558 |

- 1,7% |

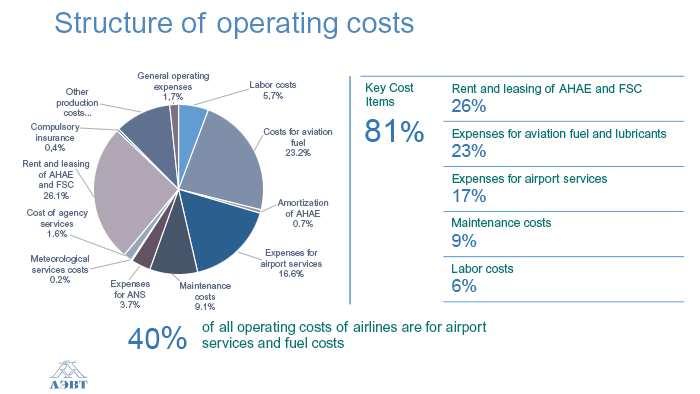

As we can see, it's time to talk not about inflating prices for air transportation by airlines, but about the real contribution of airlines to providing price accessibility of air transport services. At the same time, expenditures on the main expenditure items increased at a higher rate:

- for aviation fuel by 24%;

- for airport services by 18%.

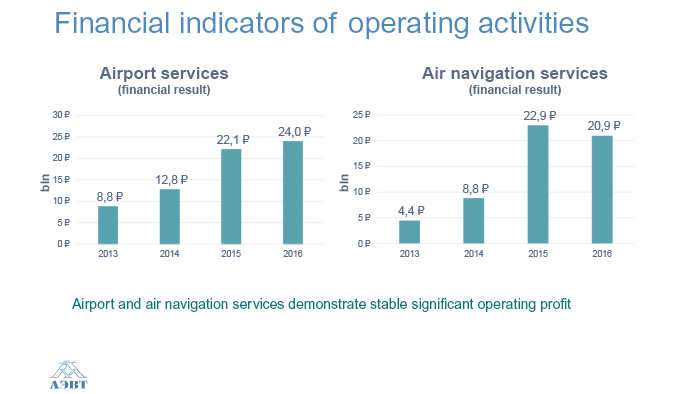

It should be noted that of the three main activities in air transport (airport services, air navigation services and air transportation), only airport and air navigation services demonstrate stable and significant profits from their operations.

We believe that most claims to airlines on pricing for their services are unfair and, often, do not correspond to the real state of affairs.

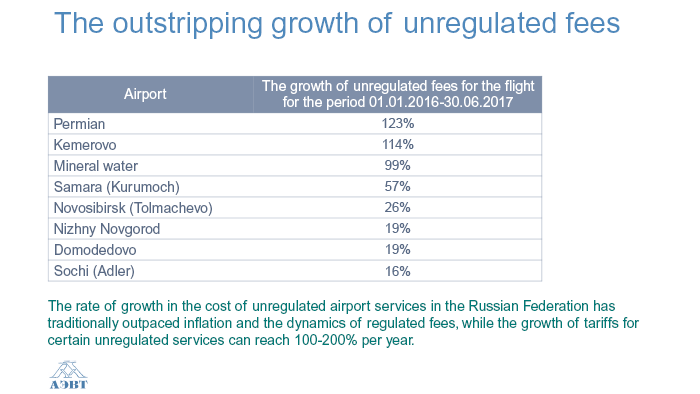

At the same time, the Federal Antimonopoly Service (FAS) of Russia has released tariffs in Moscow airports, "because there is competition". In fact, there is no competition. If we are told that it exists, then why does the competition, which, in theory, should lead to a reduction in tariffs, led to their increase? The management of airports is easy to say: look, consumer prices are rising, in the country inflation, let's increase tariffs. But the airport's expenses are mainly capital costs and depreciation expenses, which do not rise at this rate.

FAS Russia is currently initiating the reform of the antimonopoly legislation. As a result of this reform, the law "On Natural Monopolies" can be abolished or it will undergo a radical revision. In any case, as a result of such a reform, airports can be excluded from the category of natural monopolies. According to the AATO airlines, it is only necessary to give airports freedom in tariff regulation, they will not fail to take advantage of it.

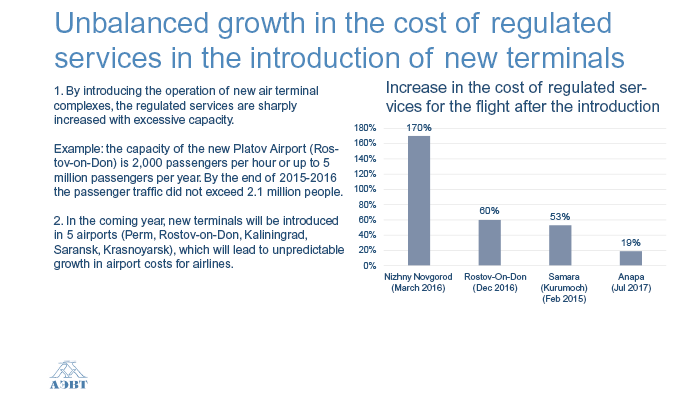

Airlines are always concerned about the cost of services at airports. We see that where tariffs are deregulated or where concession agreements are prepared, tariffs tend to increase. I will give one example, the order of the FAS Russia "On approval of tariffs (fees) for services at the new airport Platov" (Rostov-on-Don) provided by PJSC "Rostovaeroinvest" (included in the holding "Airports of Regions" of the Renova Group) This example clearly shows how the airport infrastructure of the CA of Russia will be developed and at whose expense.

In accordance with this order of the Federal Antimonopoly Service, all the rates of fees and tariffs subject to state regulation, in comparison with those existing in the still functioning old airport of Rostov-on-Don, have been radically increased:

In accordance with this order of the Federal Antimonopoly Service, all the rates of fees and tariffs subject to state regulation, in comparison with those existing in the still functioning old airport of Rostov-on-Don, have been radically increased:

- Fee for takeoff and landing - 4 times;

- The charge for ensuring aviation security - 26 times;

- Charges for the use of an air terminal (DF) - 10 times;

- Charges for the use of an air terminal (IF) - 11 times;

- Tariffs for passenger service (DF) - 4,5 times;

- Tariffs for passenger service (IF) - 7 times.

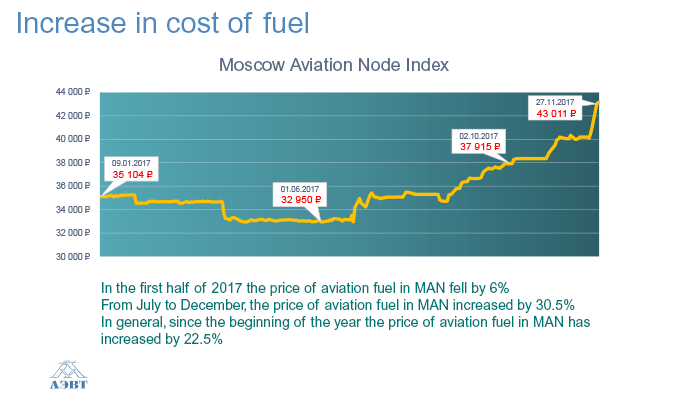

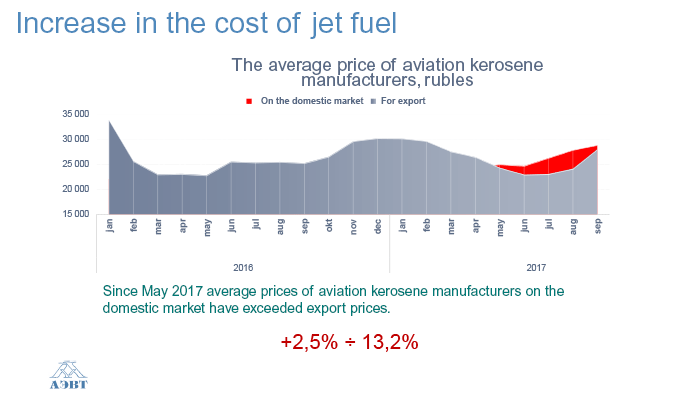

The price index for kerosene at the airports of the Moscow Aviation Node, which is determined by the St. Petersburg International Commodity Exchange, has increased by 23% to 43,011 rubles since the beginning of June. per ton.

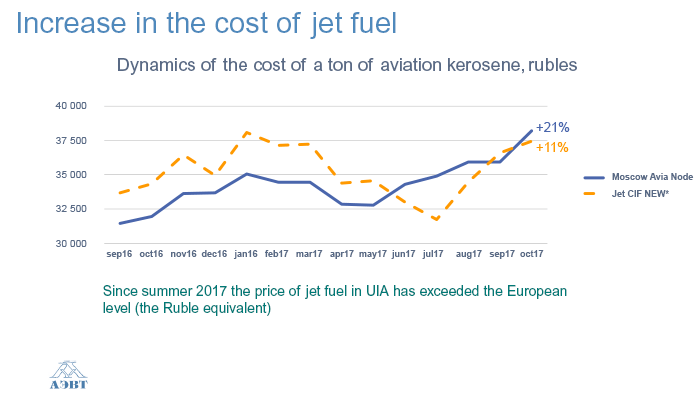

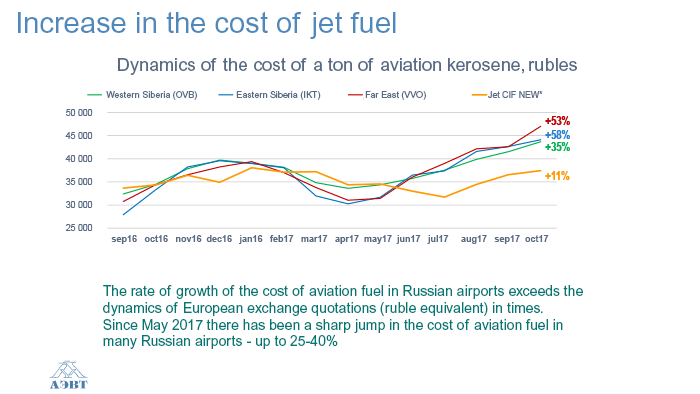

At the same time, the domestic price for aviation fuel exceeded the export price. And the rate of growth in the cost of aviation fuel in Russian airports is several times higher than the dynamics of European stock quotes.

Since the summer of 2017 the price of jet fuel in the MAN has exceeded the European level. At the moment, prices for kerosene in a number of airports in Russia are near historical highs.

Since May 2017 there is a sharp jump in the cost of aviation fuel and in many Russian airports by 25-40%.

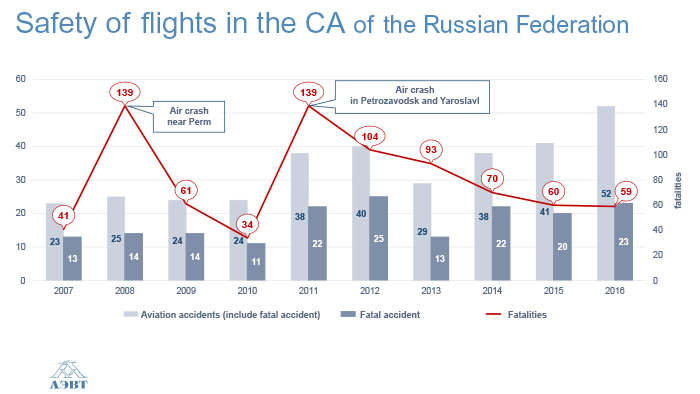

Safety of flights

The Interstate Aviation Committee (IAC) in its report indicated that in 2016 the relative accident rates in civil aviation of the States parties to the Agreement for all accidents and disasters, as well as for accidents and accidents without General Aviation (GA) are the worst for period 2012-2016 years.

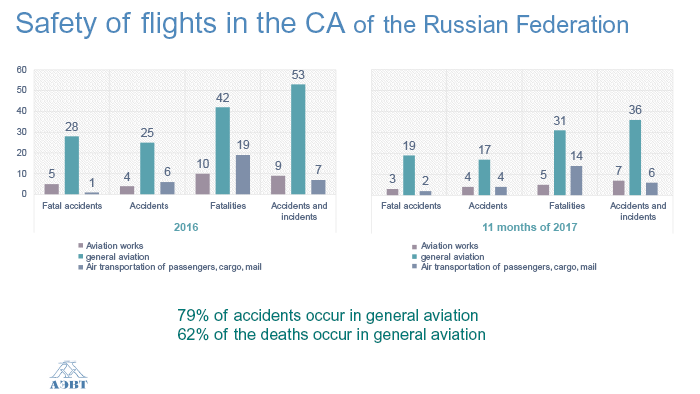

As of the end of November 2017, 49 AAs took place in the CA of Russia, including 24 catastrophes with the death of 50 people. 79% of AA occurred in GA, 62% of deaths occurred in GA.

State regulation

It should be noted that the Russian aviation authorities are making separate attempts to introduce into the country's air legislation advanced international standards and practices. But to say that the work and its systematic nature are sufficient, the participants in the aviation community of Russia can not. After the situation with the airline VIM-Avia, a whole "shaft" of initiatives to change and tighten the existing regulatory legal acts and the introduction of new requirements for air carriers. At the same time, existing norms and rules are not taken into account. All this clearly showed how our aviation administration understands the principle of "smart regulation".