|

Masalov Evgeny Vyacheslavovich the President of Sukhoi Civil Aircraft JSC

|

Dear colleagues!

On behalf of the United Aircraft Corporation, we present a long-term forecast for the development of the civil commercial segment. The event is important for us, because market expectations, the direction and the development of the airlines are crucially important for us in terms of creating a line of aircraft.

Currently, the UAC passes the period of formation and strengthening in the market. You know that in our product line there are aircraft in almost all segments from 30 seats. We understand that in order to occupy a worthy niche in the civil aviation market, it is extremely necessary and also it is necessary to be competitive not only within the Russian Federation, but also in the external market.

We are trying to take into account not only in the external appearance of aircraft due to the requirements and expectations of airlines, but in their technical characteristics. The total volume of the market until 2035 is estimated at about $ 6 trillion, 42,000 aircraft in range from 30 seats. And as I said, in almost all directions the UAC has projects in various stages of readiness.

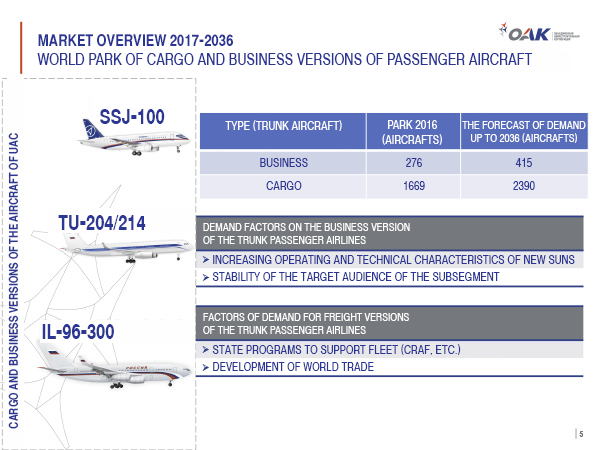

First of all, this is the Sukhoi SuperJet 100. Now about 100 aircraft are delivered, which are operated in Russia, Europe, Latin America, Southeast Asia. Yesterday GTLK under the program of Sukhoi SuperJet 100 solemnly carried out the transfer of the next aircraft to the Azimuth airline. This is an extremely important event for us, because the company is planning to revive regional air transportation in southern parts of Russia with a base at Rostov airport. Also today, we are going to sign an agreement of intent with Azimuth to increase the fleet of aircraft for the period 2020-2021, in addition to those that Azimuth will receive under the contract in 2017-2018 - these are 8 aircraft.

In the segment of narrow-bodied aircraft, where there is the most competitive market, you know that we have the MC-21 project. The aircraft has made its maiden flight this year in May and now it passes flight and certification tests. The first deliveries will be in 2019, according to our expectations it is a worthy competitor, which will take a worthy place in the park of narrow-bodied aircraft. As for the large aircraft, we have a project with COMAC - this is a Wide-body long-range aircraft.

We have registered a joint venture. There is an active work with Chinese partners, the technical shape of this aircraft has been approved, its characteristics and the family of aircraft of the Wide-body long-haul aircraft re coordinated. A joint venture has been registered, active work with Chinese partners is under way, the technical shape of the aircraft, characteristics, family are being agreed upon and we are now at the stage of the outline design.

In the segment of regional aircraft - turboprop Il-114. Last year, as you know, it was decided to launch the IL-114-300 program. The maiden flight of the aircraft is expected in 2018, deliveries in 2021. In the framework of MAKS there will be a second conference with operators, I hope that the aircraft will fully meet the expectations of regional companies and we will try to take into account their requirements.

That's about it. Now I would like to give the floor to Tamara Kakushadze, the vice president of marketing for Sukhoi Civil Aircraft.

Thank you for attention!

|

Tamara Kakushadze the vice president of marketing, JSC Sukhoi Civil Aircraft

|

Good afternoon, dear colleagues!

Literally within an hour the market forecast will be represented by our competitors - Airbus. We are not afraid, even interested, if you have an opportunity to compare our assessment with their assessment. This is some sort of professional experience for our team of marketing who represent the forecast of the UAC.

This year is a jubilee for the UAC. We have been existing for 10 years. We believe that we have achieved quite a lot of success. Starting with the fact that we have preserved and developed the competence to create civilian passenger aircraft. We have more than 100 SSJ 100 aircraft in service. MC-21 has more than 175 firm orders even at the time of certification tests.

Also, as Mr. Masalov said, this year we have signed an agreement and opened a joint venture with the Chinese aircraft corporation COMAC on the territory of China for the full-scale launch of the program to create a wide-body family.

During these 10 years we have seriously actively worked on the development of the base and tools for the formation of a qualitative, sufficiently detailed and qualified market review, its long-term forecast precisely so that our strategic objectives that are set within the product line meet the market requirements that we are expecting in the future.

I'll start with a review of the Russian market. By the volume of the transportation market to date, we occupy the 7th place in the world. We believe that by 2036 the passenger turnover of Russian airlines will grow almost 2.5 times and will reach almost 500 billion passenger-kilometers. At the same time, we estimate the average annual growth rate at 4.1%, which is slightly below the global. Over the next 20 years, according to our forecast, Russian airlines will receive, based on their needs, about 1,170 new aircraft.

The existing firm orders, which are now placed by airlines for different products in different categories, cover about 47% of the expected future demand. It is worth noting that the greatest coverage of this demand is observed in groups of narrow-body aircraft, the size of more than 120 seats. This is about 57%. Among this order, a serious share is occupied by the orders for the MC-21-300 aircraft.

We also forecast a very strong demand in the segment of aircraft with a capacity of 60-120 seats, somewhere around 15% of the total demand, which is higher than the average global figures. This is primarily due to the fact that currently active work is being carried out, including with the support of the government, to develop effective methods of stimulating sales, including the presentation of effective operational leasing. We work actively with GTLK to ensure that the proposals that we form are interesting and attractive for airlines.

CIS countries. We continue to qualify certain countries of the region in this format, because, according to our assessment, the general problems of social and economic development, close economic, cultural, interpersonal relations between our countries determine exactly the same trends. Actually, mutual dependence, including the effect of the development of the passenger transportation market. According to our forecast, the volume of passenger air travel until 2036 in the CIS countries will increase by 2.5 times. At the same time, in the world passenger turnover, passenger transportation of the countries of the CIS region is less than 1%.

We consider that, taking into account the pace of development, taking into account the stabilisation of the population migration indicators, the average annual growth rate of passenger traffic in the region as a whole over 20 years will be about 4.6%. The demand for new passenger aircraft in this region is estimated at about 260 new aircraft. Available orders, which are currently placed, cover about 18% of the estimated demand. But it is worth noting that in the countries of this region the most active buyers are the secondary market, it acquires more than half of its total demand. This was taken into account in our forecast, therefore, at first glance, it seems to you modest, but we see such forecast indicators for new equipment.

China. The next most interesting for us is the Chinese market. During the forecast period, China, according to our assessment and assessment of global institutions, will demonstrate the highest dynamics of development, including the dynamics of the development of passenger transportation. This will ensure the movement of China from the 4th position, from the regions we are considering, to the 3rd position, yielding only to the countries in aggregation such as the Asia-Pacific region and Europe, and ahead of 20 years later, North America and all other regions combined .

We expect an increase in passenger turnover in China in the next 20 years by more than 3.3 times. According to the aggregate average annual growth rate, we see that China's market may be more than 6%, which will lead to the assessment that we are demonstrating. For 20 years, the Chinese market will require more than 7,000 aircraft. This is equivalent to 1 trillion US dollars, if we evaluate this demand at catalog prices. If we talk about the portfolio of orders already available to Chinese airlines, it covers only 19% of the future demand in this market. And there is something to fight for. We estimate that the greatest demand is expected in the segment of narrow-bodied aircraft with a capacity of more than 120 seats. At the moment, it is covered by orders for 17%, it is mostly Boeing and Airbus, as well as orders for the national Chinese project C919. We believe that, based on our current connections and our potential development with China, we can claim a significant share in this market for the MC-21 aircraft.

Asian-Pacific area. Speaking about the Asia-Pacific region as a whole, but without China, it can be noted that, despite a relatively small increase in the growth rate of passenger turnover over the world average, the APR in the foreseeable future will reach practically the leading positions in the world passenger turnover market. First of all it is: India, Malaysia, Indonesia. These countries give the main drivers for the future development, make the Asia-Pacific region for all manufacturers the most interesting market, which can transform the structure of the world fleet in the future.

Concerning world passenger turnover, according to our estimates, the ATR by 2036 will take almost 20% of the world's passenger turnover. According to the UAC, the total demand for new passenger aircraft will be more than 8 600 units on this market. In this case, the emphasis will be on airpcraft of larger capacity. Although if we are talking about the structure of orders, at the moment, if we rely on our forecast, the current order portfolio covers already 43% of the expected demand. One such essential distinctive feature of this market is that the demand for wide-bodied aircraft in this region will be allocated and in the general indicators of world demand, according to our estimates, it is about 23%, which is slightly higher than the world average index.

Let's move on to the European market. The European market for the forecast period for passenger transportation will retain its leading position in the world rating, but quite serious competition will be experienced by dynamically developing economies. First of all, this will concern long-haul transportation and wide-body fleet. In this case, passenger turnover will almost double. The aggregate annual growth rate will be 3.5%. This is lower than the world average, but this indicates that the European market has already come quite a serious saturation on demand. Its current fleet is significant to provide large volumes of traffic. At the same time, the share of Europe in the world passenger turnover fleet will decrease slightly from 23% in 2016, by 2036 it will be about 19%.

It is expected that over the next 20 years, European airlines can purchase more than 8,600 aircraft. This forecast takes into account the peculiarity that the European region is leading in the rating of donors of the secondary market. It is renewing its park at an accelerated pace, transferring older aircraft to other regions. If we talk about the current portfolio of orders, it can be noted that in none of the segments by capacity, the current portfolio of orders does not cover demand by more than 30%. Naturally, in the same region, even visually clear, there is a high share of development of narrow-bodied parks. The largest share - this is narrow-bodied aircraft with a capacity of more than 140 seats.

Latin America. According to our estimates during the forecast period, the growth rate of passenger traffic in Latin America will be significantly higher than the global one, but initially modest indicators of aggregated GDP in this region will rather lead to the preservation of a serious distance in the total volume of passenger traffic relative to the region's leaders in passenger turnover.

At the same time, starting from a small base now, we expect a three-fold increase in passenger traffic, with an aggregate average annual growth rate of passenger air travel of about 5.7%. But its share in the world market of passenger transportation will not exceed 6.5% in 20 years. The total demand for new passenger aircraft is estimated at 3,400 aircraft. Of the announced firm orders for new aircraft, only 29% of our forecasted demand is covered. A record high share of shipments is expected in the segment of narrow-bodied aircraft with a capacity of 120 or more seats.

Near East. Also an interesting market for the UAC. Along with China and Latin America, it will significantly outstrip other regions of the world in terms of growth in passenger turnover, but it is small in population and has a small global GDP, which will not reduce the distance between leaders and this region.

We expect that by 2036 the passenger turnover will increase almost 3.2 times, with an aggregate average annual growth rate of passenger traffic of about 6%. The share of the region in the total volume of passenger traffic will grow from 9.5% in 2016 to 12%. This is a big leap. It is worth noting that more than half the supply of new aircraft we see in the wide-body segment. Due to this, the share will increase to a greater extent. At the same time, two thirds of these deliveries are expected in the segment of a group of wide-body aircraft with a capacity of more than 320 seats. It can be said that regional airlines will provide up to 60% of the total world demand for these very large aircraft.

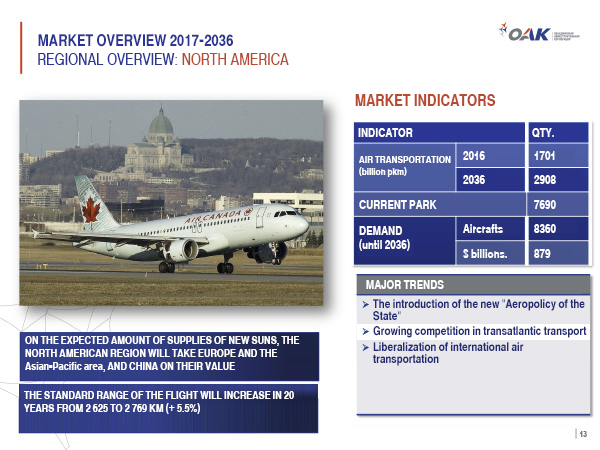

North America. The market of air transportation of the countries of the region will develop, follow the general global trends, but, taking into account the redistribution of the activity of the global economy, it will gradually lose its positions. At the turn of 2036, this market will lose the leadership of transportation not only to Europe, but also towards China and the Asia-Pacific region. At the same time, the volume of passenger air transportation, according to our expectations, will almost double, with the average annual growth rate of passenger turnover 2.7 times.

A low figure, almost the same as in Europe, but this is because of the highly saturated market, initially a large current fleet structure, there is quite a high indicator of market saturation already. What is important, according to our estimates, is the market share of the North America in the global balance sheet will decrease from 24% to 17%, yielding its position to emerging markets. A characteristic feature of the region is a high share in the expected demand for jet regional aircraft from 60 to 90 seats. This is about 19% of the total number of new aircraft in the region. At that time, according to general average world indicators, this segment accounts for no more than 6%.

Africa. Let's note prospects of the market of passenger air transportation in Africa. According to the UAC, they will be determined primarily by more than 50% increase in population over the next 20 years. In combination with fairly modest indicators on the economic development of the region. The region as a whole is strongly fragmented. Central and North Africa are very different in terms of transport performance, in terms of their structure for the formation of route networks. This brings certain adjustments, which we took into account in our forecast. In the end, we give the market of Africa by 2036 the expectation that the volume of passenger traffic will grow by 2.5 times, with the aggregate annual rate of passenger air travel at the level of global indicators of 4.5-4.6%. The share in the world market of passenger turnover will practically not change, for 2016 it is 2.1%, for 2036 - 2.2%. African airlines, due to purchases in the secondary market of aircraft, will satisfy about 41% of the total demand of passenger aircraft.

This circumstance to a large extent has determined the magnitude of demand for new passenger aircraft, which is presented fairly modestly. There are less than 1 00 aircraft for 20 years. In this situation, in spite of the current structure of the park, we see that the market of wide-body aircraft promises to be the most profitable in this region. Let's just say, not by the number of seats, but by the amount of revenue that will come for manufacturers from the sale of this aircraft. The demand for wide-body aircraft is estimated for 20 years in more than 200 units.

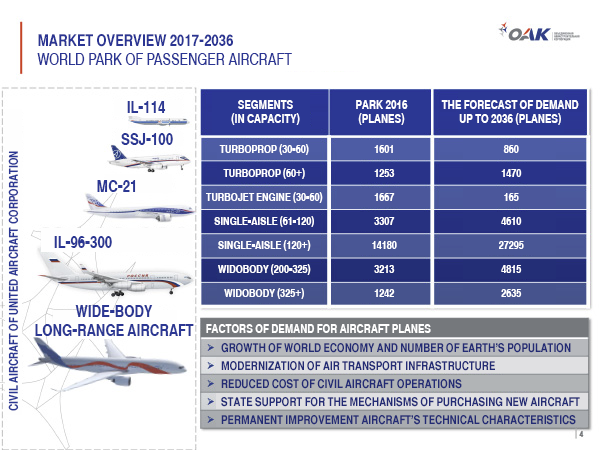

In general, speaking about the market structure and demand, which we forecast for a 20-year period, it can be noted that the world park will almost double and reach 47,000 aircraft. At the same time, it will be substantially updated, mainly due to the fact that part will be needed to update the current fleet of departing ships, some to the need related to the development of air transportation itself.

WORLD PARK OF PASSENGER AIRCRAFT

|

|

≤60

|

>60

|

≤60

|

61-90

|

91-120

|

121-140

|

140+

|

≤325

|

>352

|

|

Turboprop

|

Turbojet engine

|

Single-aisle 61-120

|

Single-aisle 120+

|

Widobody

|

|||||

|

Park of 2016 (Thousands planes)

|

1.6

|

1.3

|

1.7

|

1.5

|

1.8

|

1.6

|

12.6

|

3.2

|

1.2

|

|

Park of 2036 (Thousands planes)

|

1.1

|

2.1

|

0.2

|

2.6

|

2.9

|

2.2

|

30.8

|

5.7

|

3.1

|

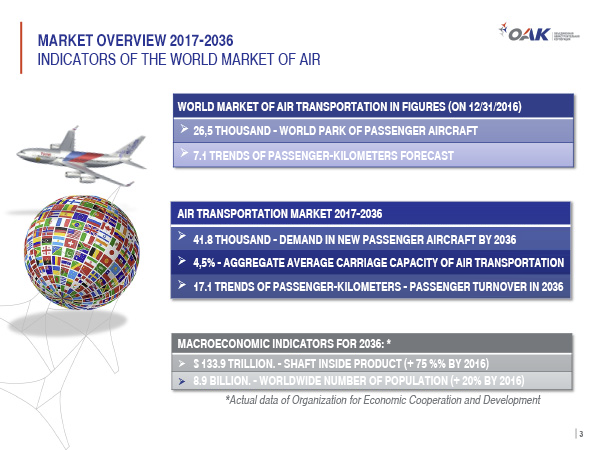

In the current projected 20 years, we estimate that, as a whole, for all markets, about 42,000 new passenger aircraft will be required. It should be noted that this demand is influenced by many factors, like demand purely in the world economy, and the increase in the population of the Earth. According to national and international organisations, the population will grow by more than 1.3 billion people in the next 20 years, which will be about 20% in growth. Indicators of world GDP will grow by more than $ 50 trillion.

The doubling of the passenger fleet will be affected by changes and modernisation of the existing infrastructure, offers on the market more aircraft with new performance indicators, which will reduce the cost of transportation and increase the mobility of the population.

In many regions, we expect government support for the airlines. There are many state programs that stimulate the development and modernisation of ground infrastructure, development of fleet of airlines. It is worth noting that the most grandiose increase (more than 140%) we see in the segment of large narrow-bodied aircraft. This is exactly the class where the proposal for MC-21 stands.

We estimate that the park of narrow-bodied aircraft with a capacity of less than 120 seats will almost double. Within the framework of the wide-bodied project, we see that an increase in the fleet of wide-body aircraft with a capacity of up to 300 seats will increase by more than 70%.

Thank you for attention.